A proud nation. PayPal study reveals attitudes to splitting the cost of festive celebrations this year

- Three quarters (75%) of Brits will feel financial pressure this year but would be too embarrassed to ask for help

- 58% say the cost-of-living crisis is making them anxious in the run up to the holidays

- Almost a third (30%) admit they will make cutbacks this year to navigate their finances

LONDON, 16th November 2022: Millions of Brits will be navigating a different type of festive season amid financial squeezing, according to new research from PayPal.

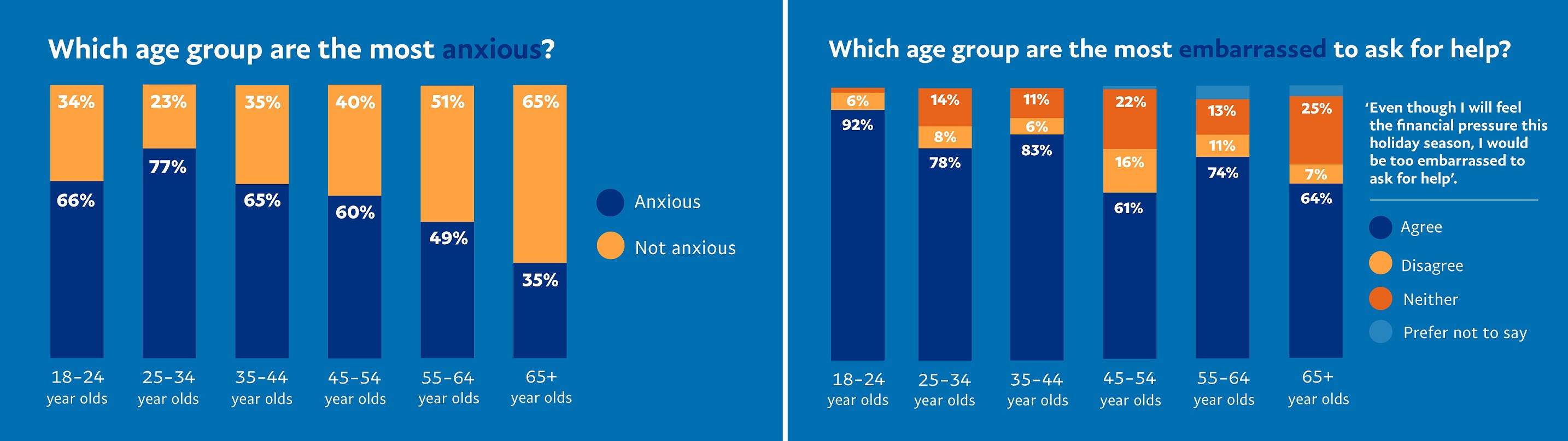

PayPal’s 2022 Holiday Snapshot Survey1, polling 2,000 UK adults in the lead up to the holiday season, revealed three quarters (75%) of Brits admit they will feel financial pressure this year but would be too embarrassed to ask for help with splitting the cost of celebrations, especially from family. Over half admit they are anxious over the cost-of-living crisis (58%) and 42 per cent say they find the holidays the most stressful time of the year – while 44 per cent are worried about financial pressure over the festive period.

‘Tis the season to split the cost

Despite anxieties around finances, many Brits aren’t planning to suggest or request splitting the cost of festivities with those they are celebrating with. Two fifths (40%) say they won’t be aiming to split the cost of gifts, and almost a third (30%) add that they won’t be looking to share the load on their festive meals.

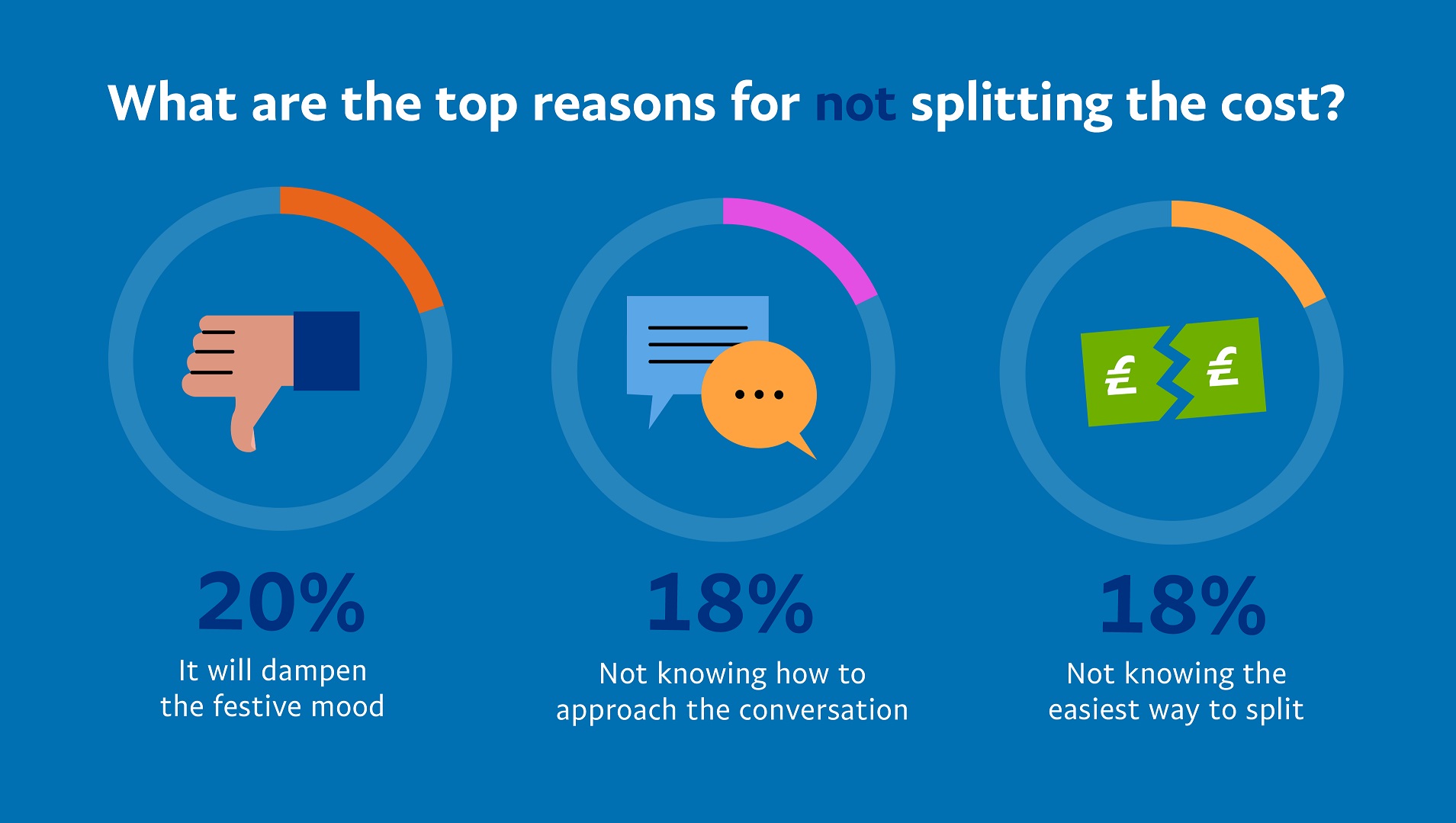

Why won’t we seek to split costs this year? The number one reason is the acknowledgement that others are also struggling with finances (53%) closely followed by not wanting to cause unnecessary worry to friends and family (49%). Additionally, many Brits are concerned talking about their financial situation will dampen the festive mood (20%), while others do not know how to approach the conversation about sharing the financial load (18%), or the easiest way to split costs (18%).

We all know that Brits by nature don’t like to ruffle feathers, and the research confirmed this, with other reasons given including worries about family conflict over finances (17%) and feeling embarrassment or shame (17%).

Generational differences

Gen Z are revealed as more than twice as likely (38%) to split the cost of gifts this year than their counterparts aged 65 and over (16%). Heartwarmingly, half of Gen Z respondents also said they would offer to help and chip in for the festivities at their grandparents’ (54%) and parents’ (49%) as they feel the older generations would be too proud of ask.

Of the parents polled, a third (30%) thoughtfully said they’d never dream of asking their offspring to help fund the festivities.

Changing festive habits

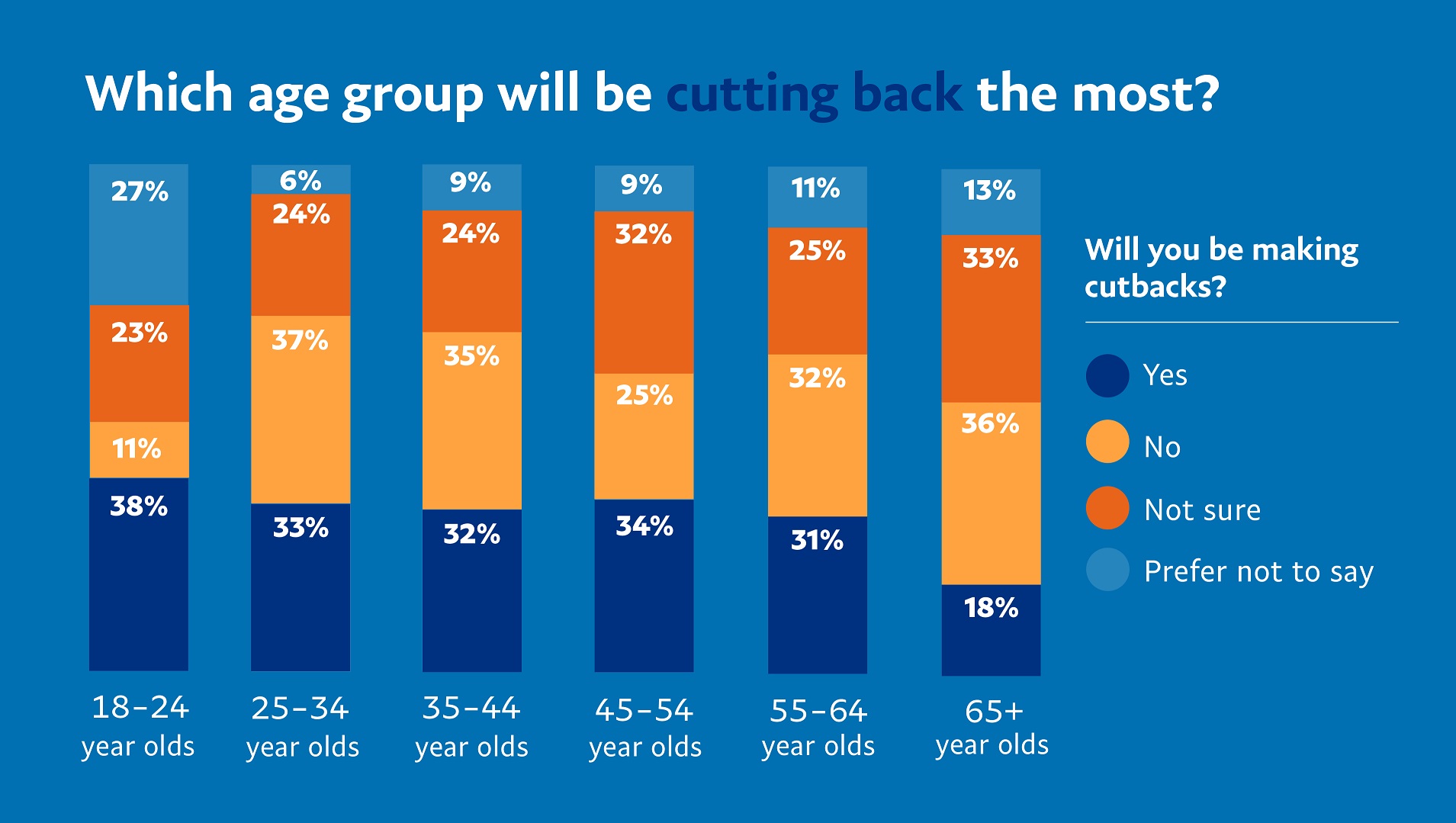

To help with keeping on top of their festive finances, many people will be making changes to their annual habits and routines. 30 per cent admit they’ll be making cutbacks this year, with top cutbacks including:

To help with keeping on top of their festive finances, many people will be making changes to their annual habits and routines. 30 per cent admit they’ll be making cutbacks this year, with top cutbacks including:

- Not buying unnecessary gifts (51%)

- Having a spending cap agreement with friends and family (34%)

- Reducing festive travel plans (33%)

- Not attending Christmas parties (27%)

- Entertaining fewer guests (27%)

- Group gifting – people pooling together to buy one meaningful gift for each family member rather than multiple gifts (25%)

The Gen Zedders are keeping things fun by organising BYOB (bring-your-own-booze) celebrations (42%) and a fifth (22%) of those polled say they will get creative this year and make their own gifts, in a bid to save on festive spend.

With financial concerns looming, Brits won’t compromise on making Christmas perfect for their loved ones, perhaps in spite of it, to keep spirits up. Almost half (45%) admit they won’t be cutting down on spending when it comes to gifting presents to family and friends, even if it means making sacrifices for themselves – while 43 per cent say that after two years of pandemic restrictions, they plan to be ‘Unapologetically Festive’ and make grand plans for the holiday season.

Where is Britain’s cost-splitting capital?

Different locations across the country demonstrate differing attitudes towards festive finances. Geographically, Brits in London are the most likely to split the cost of festive meals (41%) and gifts (41%). Meanwhile, Brits in the Northeast are the least likely to share costs with those they are celebrating with, with just 15 per cent saying they plan to split the cost of their festive meals and 16 per cent saying they plan to share the load on gifts.

According to the study, Northern Ireland leads the way on making cutbacks this holiday season, with 46 per cent saying they will change their annual habits to navigate their finances. Interestingly, over half of Scots polled say they won’t be making cutbacks this year (53%), with Scotland also topping the poll on those claiming they won’t compromise on their celebrations, even if it means making sacrifices for themself (37%).

Cost sharing is digital

Splitting bills and exchanging money with family and friends is happening online, with two fifths (41%) of UK adults now saying they use online banking apps or digital payment services such as PayPal on the occasions they do send and receive money – compared with 17 per cent % saying they would split using cash.

Vincent Belloc, Managing Director for PayPal UK noted: “The ongoing cost-of-living crisis can dampen the festive spirit as people are worried about their finances. Money management and splitting costs with family and friends is a difficult conversation. At PayPal, we’re committed to helping people share costs with our send and request money features and PayPal.me, a personalised web link that can be shared to make bill splitting a lot easier and less awkward this Christmas.”

Head to the PayPal website for more information on easy and efficient cost-splitting solutions for the festive season, such as PayPal.me.

Click here to download infographic

1 PayPal’s 2022 Holiday Snapshot Survey of 2,000 UK adults (nationally representative) conducted by OnePoll in October 2022.

About PayPal

PayPal has remained at the forefront of the digital payment revolution for more than 20 years. By leveraging technology to make financial services and commerce more convenient, affordable, and secure, the PayPal platform is empowering millions of consumers and merchants in more than 200 markets to join and thrive in the global economy. For more information visit www.paypal.com/uk/.