The new function enables individual sellers and small businesses to accept contactless payments in-person, directly on their Android devices with no additional hardware or fees for this feature.

LONDON, UK, 5th May 2022 -- PayPal Holdings, Inc. (NASDAQ: PYPL) today announced the launch of Tap to Pay with Zettle by PayPal for small businesses in the UK. The new function, which will begin rolling out today, enables individual sellers and small businesses to accept contactless payments in-person directly on their Android mobile devices, with no additional hardware and no additional fees.

The launch comes at a time where popularity of contactless payments continues to rise, with nearly 70%1 of debit card transactions and over half (56%) of credit card transactions now being contactless. In fact, since the raise of the contactless spend limit last October (from £45 to £100) the average contactless spend has increased by 29% per transaction, from £11.86 in September 2021 to £15.30 in December 2021.

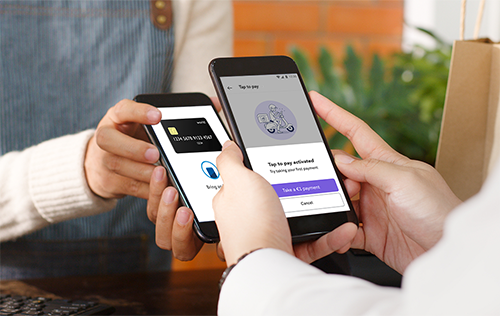

Following this shift in consumer behaviour, entrepreneurs and small businesses are looking for solutions to help them adapt and meet customers wherever they are. With Tap to Pay, individual sellers and small businesses can start accepting contactless payments within minutes of signing up with Zettle by PayPal. Sellers will be able to accept contactless payment via physical cards and digital wallets -- like Apple Pay and Google Pay -- on smartphones and connected watches, directly on their Android mobile device.

Leveraging near-field communication (NFC), Tap to Pay enables smartphones and tablets to serve as payment terminals by securely capturing card details through a contactless “tap” on the back of the device and through direct communication with card payment processing rails. The solution works on devices with Android 8.0 and NFC capabilities.

"The pandemic has accelerated the growth of new small businesses around the world. At the same time, the world is rapidly digitising, and consumers increasingly expect to be able to make seamless, digital payments whether online or in-person,” said Ben Ramsden, Director of Small Business for PayPal UK. “That’s why we’re excited to launch Tap to Pay. We believe in the power of small businesses and want to help them succeed. With Tap to Pay, entrepreneurs can quickly and easily start selling in-person – whether in a pop-up shop, at a farmers’ market, in a physical retail space, or on the go – with no additional costs or hardware needed.”

The Tram Weigh, a family-run business which brings zero-waste products and ethical shopping to its local community with its two stores, is already seeing success using Zettle by PayPal’s Tap to Pay. “Tap to Pay has made a marked difference to my ability to take card payments, whether as an additional system to complement the Zettle card readers in our shops when we’re busy or if we’re selling on-the-go at community events or fetes. It’s simple and convenient to use, I love it – it’s the way forward for my business” said Tracy Earnshaw, owner of The Tram and Rail Weigh shops.

It's simple, quick and easy to start accepting contactless payments with Tap to Pay with Zettle by PayPal:

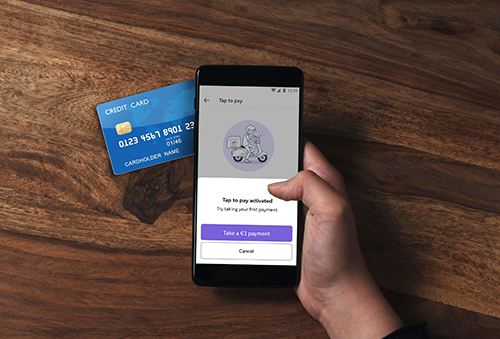

- Download the Zettle Go application on an Android device and once signed up with Zettle by PayPal, begin accepting payments within minutes. If a business owner uses PayPal, they can also sign up directly from their PayPal business accounts.

- To accept a payment, either enter a specific amount or select an item from the product library. Then select “Charge” and choose “Tap to Pay” as the payment method.

- To make a payment, customers can tap their card or digital wallet-linked smartphone or watch on the back of the Android device.

- Once the payment is approved, the business can print, email or text the receipt to the customer. The fee for accepting contactless payments via Tap To Pay is the same as the regular fee for card-present transactions, there are no additional fees for this feature.

Tap to Pay is rolling out now in the UK, Sweden and the Netherlands. We expect the solution to roll out to additional markets in the near future.

1 UK Finance Card Spending Data March 2022

About PayPal

PayPal has remained at the forefront of the digital payment revolution for more than 20 years. By leveraging technology to make financial services and commerce more convenient, affordable, and secure, the PayPal platform is empowering millions of consumers and merchants in more than 200 markets to join and thrive in the global economy. For more information, visit paypal.com.