Presenting PayPal’s annual report – The Business of Change. This year’s theme is Wellness & Empowerment as the UK’s small business community reveals the impact of the last two years, and the need for entrepreneurs to focus on caring for themselves, as well as their business needs to achieve future success.

This year’s report, which surveyed 1,000 small business owners nationwide, explores where small and mid-sized enterprises (SMEs) find themselves as the UK continues to recover from ongoing socio-economic challenges, and as we exit a volatile post-Brexit and pandemic trading environment.

Financial Wellness & Empowerment – Report Summary:

While the impact of the COVID-19 pandemic has taken its toll, many small and medium-sized businesses (SMEs) are proud of how they’ve managed to stay afloat; small business owners say they are now feeling more hopeful and optimistic about the future.

Over a quarter (27%) feel back in control of their own business while one in five (21%) feel more empowered as a business owner after the COVID-19 pandemic motivated them to improve their knowledge of their business’ finances.

Despite overcoming so much, however, SMEs say they fear the next year could be their toughest yet.

Three-quarters (78%) of business owners fear the rising cost of living will be the biggest threat to their business over the next year, not only impacting their own costs and expenses but also putting the squeeze on customer spending. Worryingly, many more (27%) fear their business might fail as a direct result of tough financial conditions over the coming year.

What’s clear is that now, more than ever, small business owners need greater support to achieve their goals and maximise growth opportunities, while navigating the challenging obstacles ahead.

“Financial woes and stress can have a negative impact on health and wellness. In tough times, staying on top of their finance wellness is a vital tool for small business owners. It needs to be a priority to minimise the personal impact of running a business, which can be an isolating and challenging experience for entrepreneurs. As a trusted partner, we help to empower small business owners to manage their financial wellness by providing simple tools and technology to ease unnecessary stress by offering them seamless payment solutions, so they can focus on the big picture.” – Ben Ramsden, Head of SMEs, PayPal UK

Our results at a glance:

- Three quarters (78%) of small businesses cite the immediate cost-of-living to be the biggest threat to their business over the next year.

- A quarter of small businesses are ignoring the financial health of their business because they’re worried what further scrutiny might uncover.

- Worryingly, one in ten (12%) business owners do not expect to be in business within the year, with a further 15% unsure of their business’ future.

- However, one in five said the last two years have had a positive impact on their ability to manage their finances.

- Over a quarter (27%) feel back in control of their own business after experiencing uncertainty and one in five (21%) feel more empowered as a business owner since improving their knowledge of their business’ finances.

The value of financial wellness

Just as physical and mental wellness are critical for business owners to perform at their best, financial wellness is key to overall business growth and success. Optimal financial wellbeing is when business owners have a clear picture and understanding of their business’ financial health and what they still need to do to achieve success.

Our first Recovery & Rebuild report in 2021, found that over a third (35%) of UK SMEs said the pandemic had been a positive catalyst for change. Nearly half (45%) said they would increase their use of technology to support growth, including new payment options and app technology. Around 40 per cent of small businesses (two in five) said they planned to expand to new markets over the coming year.

Achieving these goals – and financial wellness as a whole – requires a set of smart and robust tools and resources that empower business owners, helping expand customer reach and engagement, boosting sales and managing cash flow, all of which can help businesses weather challenging times.

Overcoming financial barriers to success

Our research from this year has found that two thirds (67%) of small businesses consider the last two years to have been the most challenging since they started their venture – but nearly a quarter (24%) fear the next 12 months could prove even more difficult.

By far the biggest concern is the rising cost of living, something that looks set to overshadow even the disruption of the global COVID-19 pandemic and Brexit. Nearly half (40%) of business owners say reduced customer spending is having a negative effect on cash flow, while over a third (35%) are feeling the pressure from hefty fuel and energy price hikes. Late payments from customers are also having a significant impact on business for one in five (21%) SMEs.

Managing cash flow is such a concern that nearly a third (27%) of small businesses think there is a possibility they will go out of business within the year: one in ten (12%) do not expect to be in business in a year’s time, with a further 15 per cent unsure of their business’ future. Having access to funding such as PayPal Working Capital can be a vital lifeline for businesses to take the stress out of payments and help financial management, to become a moment to feel more in control, as well as capitalising on seasonal growth opportunities as they arise.

“In all honesty, it’s been a stressful time these past few years, and as an entrepreneur, I continue to struggle with juggling the demands of my business with a healthy balance in my personal life. What has really helped is using PayPal Working Capital as a key funding option to keep my business out of the red. It’s the easiest funding route I’ve used by far – and it means I can relax and spend time working on what I enjoy doing from my business, safe in the knowledge that I’m balancing the books!” – Phil James, Founder of &SONS

Burnout facing Britain’s entrepreneurs

Worries about cash flow and future profits have led to many British entrepreneurs pulling out all the stops to keep their business afloat.

Nearly half (44%) of small business owners say they regularly work weekends. More than a third (36%) will go at least six months before taking a holiday or time off, if at all.

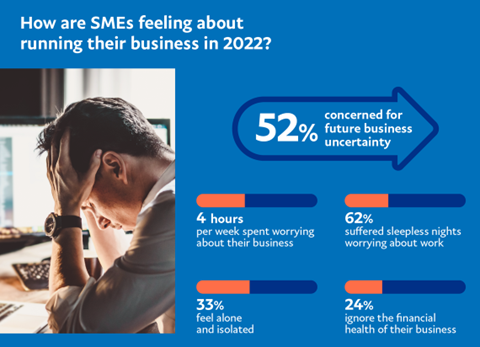

Feelings of loneliness and isolation have also been common among SMEs as they’ve struggled to cope with the pressures of keeping a business going. More than half (52%) of SMEs have felt concern for the uncertain future of their business, while a third (33%) say they’ve felt alone and isolated. Events around the world have also had a negative effect for over two-fifths (42%) of business owners.

Given the current challenges, it’s not surprising that three in five (60%) owners admit to finding running their business stressful. Feelings of being overwhelmed may also be influencing why a quarter (24%) admit to ignoring the overall financial health of their business, worried about what closer scrutiny might uncover.

Despite these worries, there is light at the end of the tunnel. A third (31%) of SMEs say they still feel a sense of success or achievement in themselves, and an encouraging one in five (28%) feel optimistic about new opportunities in future.

Key calendar dates in the year ahead promise a much-needed profit boost for SMEs. Over a third (32%) of business owners say they’re looking forward to Christmas being positive for business – the first time in three years with no UK restrictions to hamper the busiest sales period of the year. Meanwhile, 16 per cent believe the Queen’s Jubilee Bank Holiday will boost profits with the extended Bank Holiday weekend giving customers more opportunity to shop.

Empowering SMEs to achieve financial wellbeing

Small business owners have learned important lessons from the past two years, and report a renewed sense of self confidence in their business and their own abilities.

Over a quarter (27%) of SMEs say they feel back in control of their own business after experiencing uncertainty, while more than half (53%) say they’ve learned from past mistakes.

“Our biggest challenge has been the rising cost of raw materials but we’re reluctant to raise our prices to avoid impacting our customers – it’s a lot of pressure to deal with. Since relaunching our website last year, our sales have increased, with 80 per cent now being made online solely via PayPal. It has really helped to ease some of the associated stress and I’d certainly recommend other small business owners who are feeling the strain to invest in their social media presence to drive online growth further”. – Sandy Ruddock, Co-Founder at Scarlett & Mustard

Regaining control of their financial wellbeing has taken various forms, including training and upskilling in new technology, with PayPal for Business one way for SMEs to upskill further with PayPal’s product support. A third (31%) of SMEs say they’ve taken steps to upskill, using finance apps to develop their own financial literacy skills and help manage company finances. As a result, more than half (56%) now feel more financially savvy, and a quarter (25%) feel empowered by their own leadership abilities.

The personal impact of a financially healthy business

The impact of having a financially healthy business is far-reaching - boosting self-confidence, building savings and emergency funds, as well as providing a strong foundation from which SMEs can expand further, including into international markets.

Nearly half (45%) of all British entrepreneurs say they now feel more confident in themselves as business leaders. More than four in ten (42%) business owners say they are able to save more for the future. Two in five (39%) say that running a financially healthy business causes less overall stress. For a third (31%), a financially healthy business means they are able to pay off their debts, as well as treat themselves (33%) or go on holiday (31%).

Having a financially healthy business is also creating new opportunities for small business owners, allowing them to plan for their business’ future success. This includes having the confidence and financial foundation to explore new opportunities for growth. A quarter (24%) of SMES say they have plans to grow through future expansion. Leveraging PayPal’s reach of more than 425 million accounts is a perfect way to help support future growth.

Empowering entrepreneurs with PayPal’s Commerce Platform

But what does this all mean for Britain’s SME community? In an environment of falling consumer spending, increasing late payments, as well as rising costs of fuel and raw materials, a strong and financially fit business foundation is crucial for UK SMEs to survive. Smart tools and resources that can help SMEs boost sales, expedite payments, deliver flexibility on payment options and create exciting offers for customers – can all have a direct and positive impact on cash flow and finances as a whole.

Achieving financial wellbeing requires flexible tools which support and empower SMEs in growing their business, whether it’s expanding markets and reaching more customers worldwide, helping manage cash flow, and facilitating sales growth both online and in-store. As a reliable, trusted partner in business, with millions of active accounts in over 200 markets, PayPal is a perfect solution for those looking to take the stress out of managing their business finances.

The PayPal Commerce Platform is a comprehensive solution designed to help serve the needs of small businesses and their customers. Whether a business is just getting started or already thriving, PayPal opens up access to new international customers with ease, enabling support for shopping preferences and business growth.

-

Help grow sales with PayPal Checkout is a trusted solution that gives busy entrepreneurs peace-of-mind and lets your customers pay the way they want to. There’s the added benefit of having access to this on major ecommerce platforms such as BigCommerce and WooCommerce, to help further boost sales and tap into customers on multiple convenient online and offline sales channels.

-

Customers will be looking for flexible payment options like Pay in 3, which spreads the cost of a purchase over three payments, interest free. Used responsibly, it gives customers another option to manage their budgets and supports SMEs in their ability to plan ahead and manage finances

-

Financial flexibility and wellness go hand in hand. PayPal Working Capital is a funding option that provides flexibility to spend funding where SMEs need it most. Instead of repayments with set instalments, repayments are automatically deducted from their PayPal account as a percentage of each sale until the cash advance and fixed fee are paid in full. Approval is based on PayPal sales and account history making applying simple and a decision is usually received straight away*, which can often make a real difference in financial management for SMEs who are wearing many hats – in addition to running their business.

-

Zettle by PayPal can help SMEs grow their in-store business. The card reader and mobile POS app make it easy for small SMEs to run their business and accept payments securely in their store or on the go. Tap to Pay with Zettle by PayPal enables individual sellers and small businesses to accept contactless payments in-person directly on their Android mobile devices, with no additional hardware and no additional fees.

As a trusted global partner, PayPal’s Commerce Platform offers financial and digital solutions and arms SMEs with the resources they need to help grow their business, reach more customers, support boosts to cash flow and create strong opportunities to achieving overall financial wellness. For more information and guidance on PayPal's available products to suit your small business needs, click here.

END

*Eligibility assessed as at date of this report and remains subject to bankruptcy, compliance and other standard checks. Funding time is typically less than a minute. PayPal sales history and account behaviour, along with other criteria, are used to determine eligibility and the advance value offered. PayPal reserves the right to review and amend its eligibility criteria without notice. See full terms: paypal.com/gb/workingcapital/terms

** Pay in 3 availability is subject to merchant status, sector and integration. Consumer eligibility is subject to status and approval. See product terms for more details.