LONDON, Wednesday 18th May: Nearly a quarter (24%) of young adults admit the cost-of-living crisis is the leading cause of anxiety in their life, with rising energy bills (46%), petrol (44%) and food prices (43%) hitting their finances the hardest.

PayPal UK polled 1,000 UK Gen Z adults (aged 18 – 25 years) for the Gen Z Financial Wellness Study1 to explore their greatest money challenges and if and how they are planning for their financial future. The research reveals that despite the cost-of-living crisis, Gen Z have heightened their focus on saving and financial independence, and are reshaping how to make and save money.

Lifestyle Changes Can Be Cost Saving

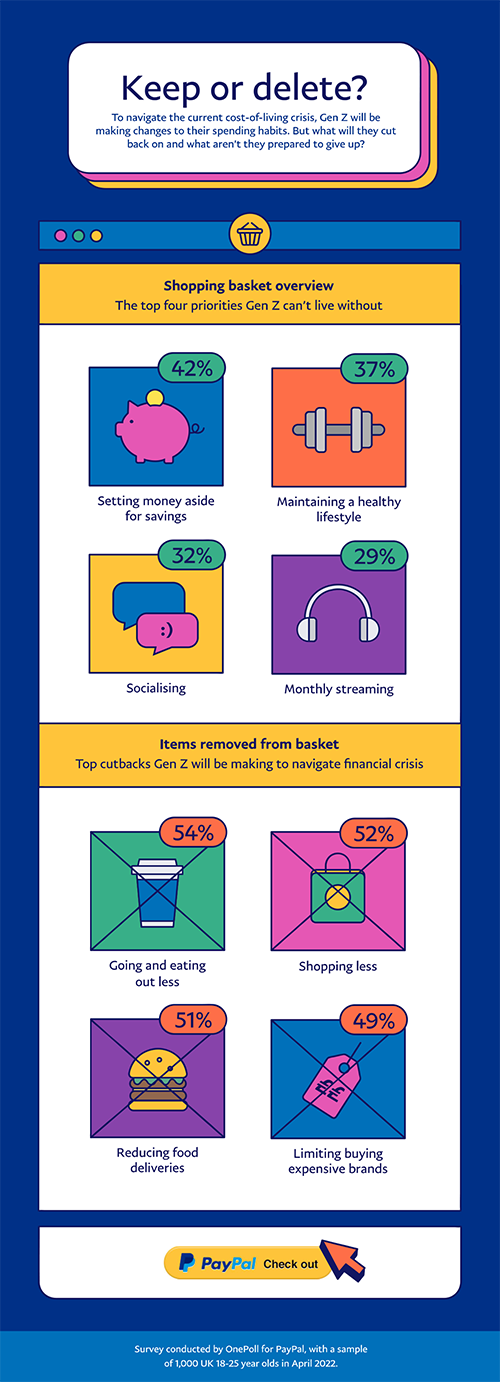

The research found three quarters (76%) feel compelled to change their spending habits to navigate the current financial landscape – far higher than the 58 per cent of millennials who are looking to make similar changes. Going out less will be the first cut-back for over half of Gen Z (54%), swiftly followed by shopping less (52%) and reducing food deliveries (5%). Worryingly, one in 10 (12%) say they will have to reduce their pension contributions too, rising to 27 per cent amongst young Scottish adults.

A testament to the generation, there are some things Gen Z refuse to compromise on– with setting money aside for savings coming out on top (42%), followed by leading a healthy lifestyle (37%) and socialising (3%). In order to do so, savvy Gen Z are creating budgets to stick to (44%), looking out for discounts (43% ) and tracking their spending via banking and mobile apps like PayPal (40%).

Finding Their Financial Footing

Encouragingly, 80 per cent of Gen Z feel confident they’ll achieve their financial goals, with over half (55%) believing they will reach them within the next 6 years.

Although set on saving Gen Z have some reservations about the future, worrying most that they’ll never own a property (33%) or even start a family (26%). Many of Gen Z are stepping away from traditional financial ambitions, aiming for more attainable goals such as having a good credit score (20%) and having a ‘rainy-day’ fund (19%) With simplicity at its root, the top financial goal for a quarter (25%) of Gen Z is to simply not be worried before they look at their bank balance.

Everyday They Are Hustling

Attaining financial wellness is a tough task. With an average of just £320 left at the end of each month2, dropping to £264 for in East Anglia, and £268 for those in the North West of England, half (51%) of young adults agree that they find it impossible to save money.

The research found Gen Z is taking matters into their own hands to secure their financial future and in search of extra income, half of them (51%) work a second job or a side hustle – a figure rising to 61 per cent for Londoners - helping them to generate an extra £248 on average each month. Of those supplementing their primary income, an average of 70 per cent of do this through a side hustle. Scottish young adults top the UK for this entrepreneurial spirit at 83 per cent, while South East England comes out at the bottom, at 50 per cent.

What are the top side hustles for UK Gen Z?

- Making and selling items or food (16%)

- Content creation and gaming (14%)

- Looking after children or animals (10%)

- Putting money into shares/stocks (10%)

How do they get paid? Cash in hand is becoming a thing of the past for Gen Z, with 58 per cent using money-transfer services and two in five getting paid via mobile apps for their side-hustle.

Blaz, 25 years-old from London, manages a full-time job as a corporate receptionist, but dedicates his spare time during evenings and weekends to building his online spice business: “As a teenager I discovered my passion for cooking and exploring different spices. When I was furloughed in 2020, I was the given space and time to grow that passion into The Spice Avenue, a business that sells ecological conscious, hand-blended spices to those looking to start their cooking journey. Now I’m back in full time employment, I use my spare time to keep my business running and growing. Currently, I’m saving the extra income I make through The Spice Avenue towards the deposit for a house. It’s so great to see that dream becoming more of a reality!”

Vincent Belloc, Managing Director for PayPal UK, comments “The cost-of-living crisis is impacting us all, but for Gen Z, it’s the first time they’ve had to battle soaring inflation. Money can be an awkward conversation, as a company, and as a society, it is critical that we support young adults to reach their financial goals by sharing our experiences and advice, and actively addressing any knowledge gaps. At PayPal, we're committed to connecting these young adults to a range of resources and guidance to empower them on their journey to financial wellness, with tips on how to spend smartly and advice from top financial coaches on how to boost your income."

Head to the PayPal website and newsroom for smart-spending guides and expert advice.

1 PayPal’s Gen Z Financial Wellness Study1 survey of 1,000 UK Gen Z adults (aged 18 – 25) and 1,000 Millenials (aged 25-41) conducted by OnePoll in April 2022

2 Typical monthly take home pay coming in at £1,468 from their main job and outgoings averaging £1,034

About PayPal

PayPal has remained at the forefront of the digital payment revolution for more than 20 years. By leveraging technology to make financial services and commerce more convenient, affordable, and secure, the PayPal platform is empowering millions of consumers and merchants in more than 200 markets to join and thrive in the global economy. For more information, visit paypal.com.